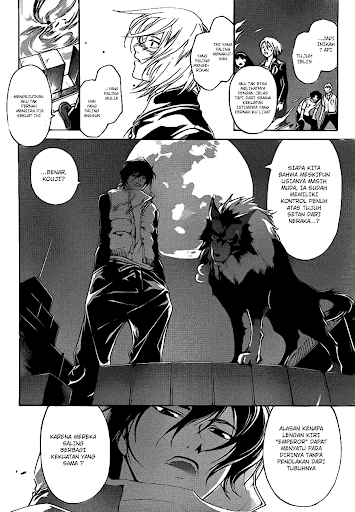

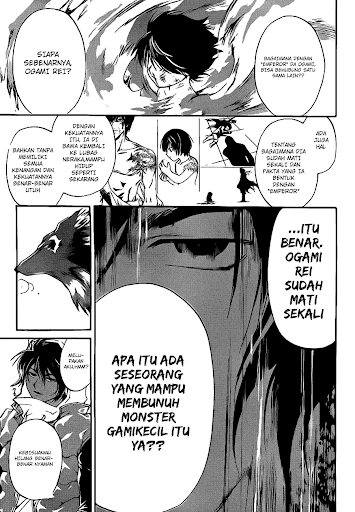

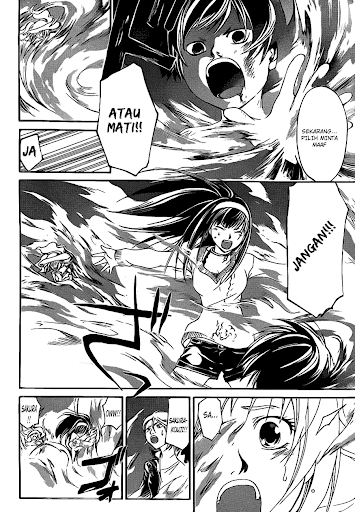

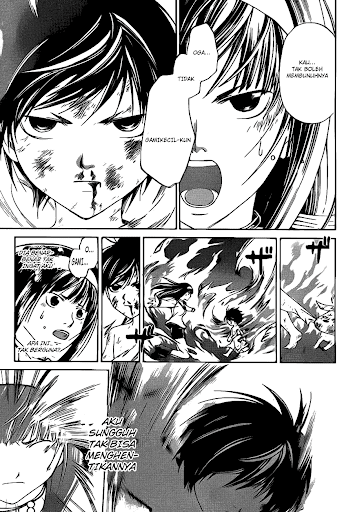

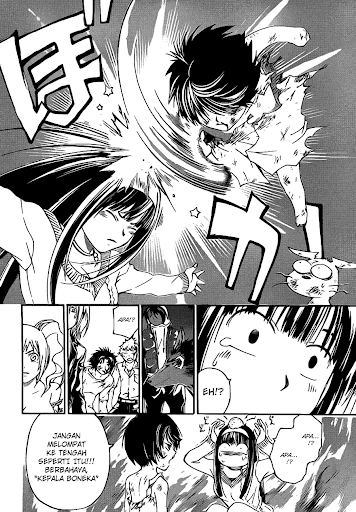

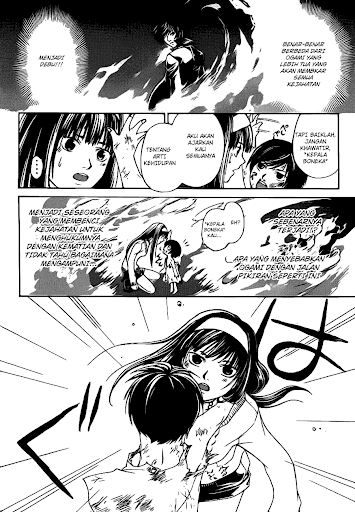

Code Breaker 121 Bahasa Indonesia, Next Komik COde Breaker 122 Bahasa Indonesia.

Current market value of home minus outstanding mortgage loan. Home equity is basically the amount of ownership that has been built by the mortgage holder through payments and appreciation. Typically, residential property bought through a mortgage, which is then paid in full for several years, often 15 or 30. Once the mortgage has been repaid, the property then owned by mortgagor, the purchaser. For a while, however, the buyer only accumulate equity in the home. This is what a home equity loan borrows against. Although the equity that can not be sold, banks will lend money against it.

Home equity loans offer significant tax savings because of the fact that the interest paid on home equity loans tax-deductible. Home equity loans are often used to consolidate other debts with high interest rates (such as credit card debt), to finance large expenses (such as universities or marriage), or to buy other expensive items. There are two main types of home equity loans. The first type is the traditional home equity loans, also known as second mortgage, the lender a lump sum of money to be repaid over a certain period. The second type is a home equity line of credit, which provides the borrower with a checkbook or credit card used to borrow against home equity. Funds borrowed from a traditional home equity loans start accruing interest immediately after the lump sum disbursed, the funds borrowed from home equity line of credit does not begin to bear interest until the purchase is made to equity.

Current market value of home minus outstanding mortgage loan. Home equity is basically the amount of ownership that has been built by the mortgage holder through payments and appreciation. Typically, residential property bought through a mortgage, which is then paid in full for several years, often 15 or 30. Once the mortgage has been repaid, the property then owned by mortgagor, the purchaser. For a while, however, the buyer only accumulate equity in the home. This is what a home equity loan borrows against. Although the equity that can not be sold, banks will lend money against it.

Home equity loans offer significant tax savings because of the fact that the interest paid on home equity loans tax-deductible. Home equity loans are often used to consolidate other debts with high interest rates (such as credit card debt), to finance large expenses (such as universities or marriage), or to buy other expensive items. There are two main types of home equity loans. The first type is the traditional home equity loans, also known as second mortgage, the lender a lump sum of money to be repaid over a certain period. The second type is a home equity line of credit, which provides the borrower with a checkbook or credit card used to borrow against home equity. Funds borrowed from a traditional home equity loans start accruing interest immediately after the lump sum disbursed, the funds borrowed from home equity line of credit does not begin to bear interest until the purchase is made to equity.

No comments:

Post a Comment